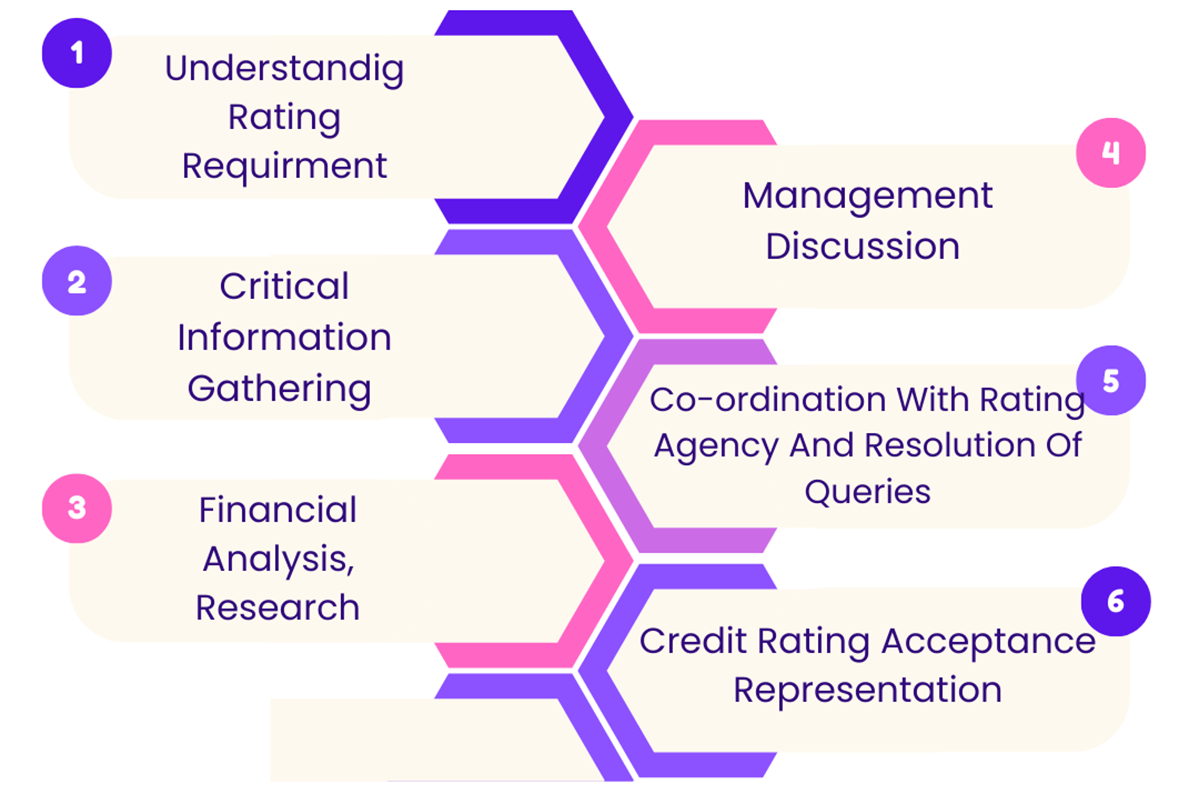

Understanding Rating Requirement

The company provides the necessary critical information for our primary data analysis. We understand the credit rating requirement, prepare preliminary analysis and discuss the credit points and possible outcomes.

Critical Information Gathering

We gather critical supporting/supplementary data relevant to the company or the industry sector essential for emphasising the company’s business and financial strengths.

Financial Analysis & Research

We conduct an in-depth analysis of past financial statements, future business and financial strategies, peculiarities of the industry/sector, regulations etc. We also compare the company with industry peers for obtaining rating insights. On basis of our analysis, a credit story is conceptualised which is discussed with the management for critical matters and areas for improvement.

Management Discussion

We prepare the management for discussion with Credit Rating People. We share key details, probable list of queries and credit highlights that need to be covered during the management discussion. Our team co-ordinates regularly with rating people for follow-on discussion and submission of additional inputs if any.

Co-ordination with Rating Agency

We act as your trusted partner, offering full support while presenting and discussing your case with the chosen rating agency. Our hands-on approach ensures all necessary information is provided, ensuring a collaborative, successful and time-bound process.

Credit Ratings Finalization

We specialize in crafting critical as well as supplementary materials that enhance the precision of creditworthiness evaluations conducted by rating agencies. Our services empower companies to present a comprehensive and precise assessment, enabling informed credit decisions. We also assist you in representation of your case if at all required.